Kribatta serves as your personal FinTech bank, managing both corporate funds and personal transactions.

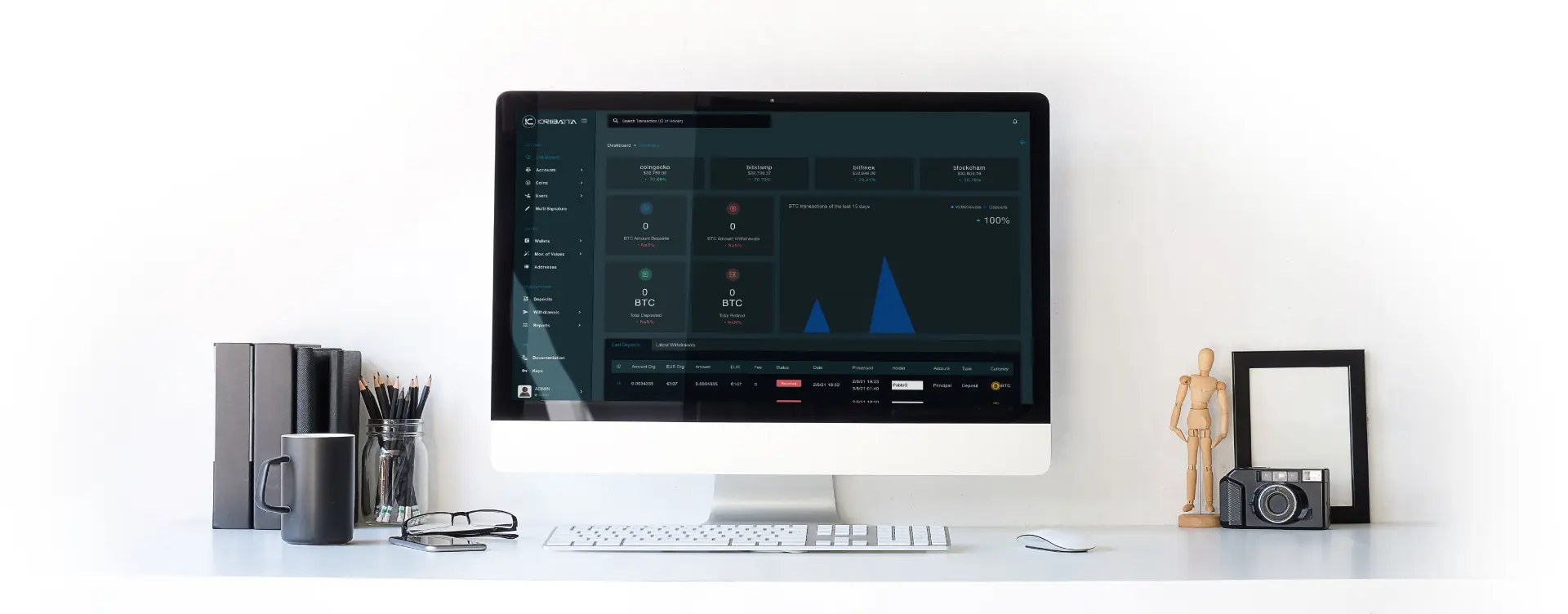

Kribatta's corporate interface provides a dynamic and versatile tool, integrated seamlessly into your business operations. It allows an effective fund management and transaction execution in a variety of currencies, both crypto and fiat.

Manage your funds, accounts and clients with the backend CryptoBank Interfase

POS processing embeded in your website

Process Bulk payments to customers, suppliers and other in Crypto or Fiat

Settle Your Crypto Funds into external fiat accounts

Manage and pay your employees in Crypto or Fiat

Features and tools for your clients such as memberships, automatic charges and much more...

Make payments to your suppliers on a single or batch way

Run and analyze your transactional reports in real time

![]() Interactive Dashboard

Interactive Dashboard

![]() Crypto

Crypto

![]() My Kribatta Accounts

My Kribatta Accounts

![]() Banking

Banking

![]() Bulk Payments

Bulk Payments

Visualize your transactions and your entire business flow with interactive graphics.

Manage your master wallets, hot and cold wallets from the same screen, even send funds to other wallets easily.

View your clients or business affiliates on a simple screen, where you can see their wallet addresses (not balances) and even enable or disable their accounts.

View all your bank accounts and transaction details or transfer from your corporate accounts to any of the options we have enabled for your convenience.

Kribatta will surprise you with its Batch Payment Option (BPO), where you can transfer funds in different currencies, to different recipients with a single click; displaying its value in dollars and its execution status. Schedule your payroll, the payment of your associate network or your suppliers with this simple but versatile option.

Efficient payroll processing.

Purchase Cryptocurrency (BTC, USDT, and ETH.)

Global remittances and batch payments to suppliers.

Access to a branded international Master Card.

Benefit from advanced encrypted security and validation protocols.

Seamless API integration with client platforms.

A diverse selection of Crypto and fiat wallets, both hot and cold.

Dual interfaces tailored for both individual clients and corporate entities.

Continuous development of client- specific products.

Robust profile management, including password security and two-factor authentication.